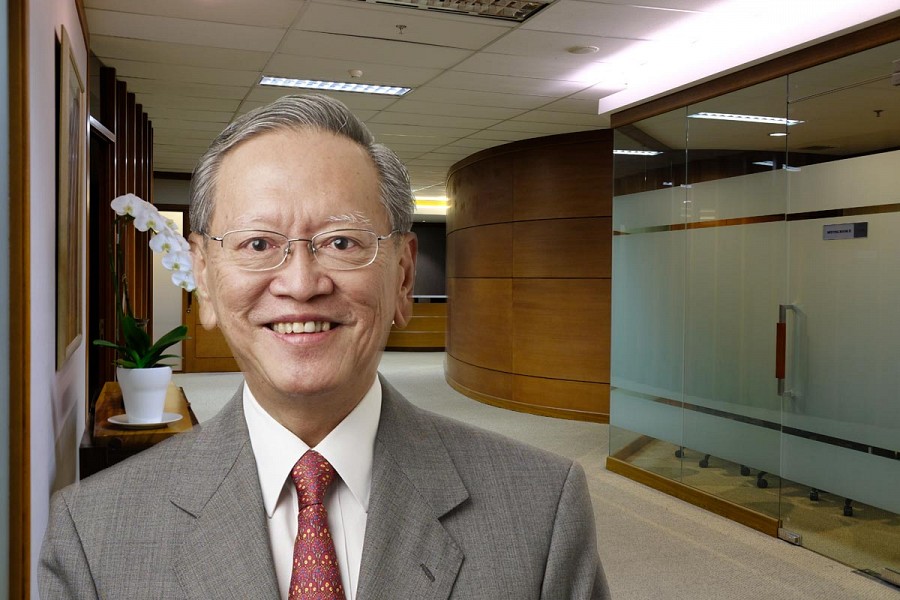

Our Firm

Every transaction, whether involving a new venture, changes to an existing business structure, or a review of contractual arrangements, has direct or indirect tax consequences.Team

Harsono Strategic Consulting (HSC) is an independent firm providing business and related tax and customs advisory services to multinational corporations, joint ventures and domestic companies in a wide range of business sectors.Expertise

HSC is well equipped to assist clients with their taxation affairs and related business issues.

Tax Consulting

We can help by providing advice on the tax implications of a contemplated structure or agreement, evaluating risks, and formulating a strategy to minimize tax costs.

Read More

Tax Dispute Resolution

We can help with a tax audit and the objection, appeal and judicial review process, and formulate a strategy for handling the case in the most effective manner.

Read More

Transfer Pricing

We can prepare transfer pricing documentation and carry out a comprehensive risk assessment review to identify and quantify the risk of transfer pricing adjustment in advance of Indonesian tax authority scrutiny.

Read More

Customs and Excise

We can help obtain exemptions and other facilities, customs clearance, and assist with customs audits and disputes.

Read More

Business Advisory Services

We can structure tax efficient deals and conduct due diligence reviews.

Read More

Publications

Our newsletters keep our clients apprised of important changes to Indonesia's tax, customs, and investment regulations.News

Recent news from Indonesia is provided to keep you informed and up-to-date.OJK sebut tata kelola, kepatuhan pengarah pertumbuhan berkelanjutan

Ketua Dewan Komisioner Otoritas Jasa Keuangan (OJK) Mahendra Siregar menyampaikan bahwa tata kelola, manajemen risiko, ...

Ketua Dewan Komisioner Otoritas Jasa Keuangan (OJK) Mahendra Siregar menyampaikan bahwa tata kelola, manajemen risiko, ...

OJK sebut tantangan ITSK jaga keseimbangan inovasi & manajemen risiko

Otoritas Jasa Keuangan (OJK) menyampaikan tantangan terbesar inovasi teknologi sektor keuangan (ITSK) yakni menjaga ...

Otoritas Jasa Keuangan (OJK) menyampaikan tantangan terbesar inovasi teknologi sektor keuangan (ITSK) yakni menjaga ...

RKAP disetujui, Danantara siap lakukan investasi

Chief Executive Officer (CEO) Badan Pengelola Investasi Daya Anagata Nusantara (Danantara Indonesia) Rosan Roeslani ...

Chief Executive Officer (CEO) Badan Pengelola Investasi Daya Anagata Nusantara (Danantara Indonesia) Rosan Roeslani ...

Citi Indonesia: Target pertumbuhan ekonomi 5,4 persen 2026 realistis

Citibank, N.A., Indonesia (Citi Indonesia) menilai target pertumbuhan ekonomi yang dipatok pemerintah sebesar 5,4 ...

Citibank, N.A., Indonesia (Citi Indonesia) menilai target pertumbuhan ekonomi yang dipatok pemerintah sebesar 5,4 ...

Danantara pastikan aturan tantiem direksi dan komisaris sudah berjalan

Badan Pengelola Investasi Daya Anagata Nusantara (Danantara Indonesia) memastikan peraturan terkait pemberian tantiem ...

Badan Pengelola Investasi Daya Anagata Nusantara (Danantara Indonesia) memastikan peraturan terkait pemberian tantiem ...

LPS siapkan klaim penjaminan nasabah BPR Disky Suryajaya di Sumut

Lembaga Penjamin Simpanan (LPS) menyiapkan proses pembayaran klaim penjaminan simpanan dan pelaksanaan likuidasi PT BPR ...

Lembaga Penjamin Simpanan (LPS) menyiapkan proses pembayaran klaim penjaminan simpanan dan pelaksanaan likuidasi PT BPR ...